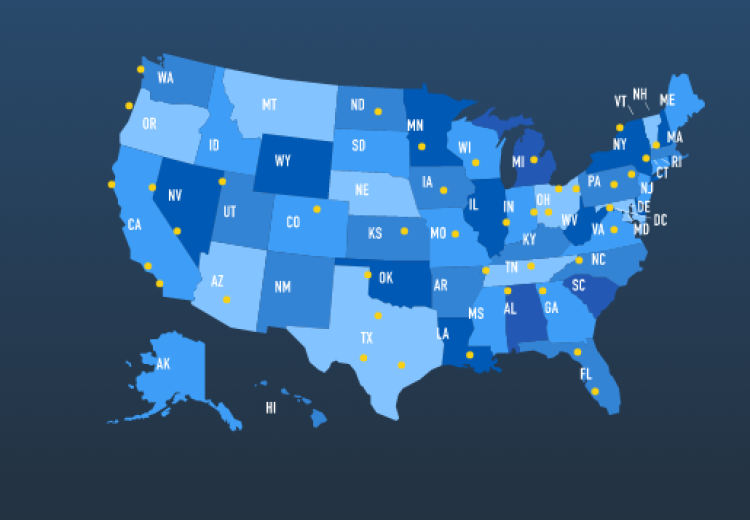

Cummins Allison

Transition from Cummins Allison to One CPI

In 2020 CPI joined forces with Cummins Allison to create a powerful portfolio of cash and automation solutions that will support our customers and partners achieve their business goals. We are now One CPI.